Stop Wasting Money on Petrol: Find Your Best Fuel Credit Card in 30 Seconds

Calculate your specific savings based on your monthly commute.

Published: January 15, 2026 | Last Updated: 1 February 2026

Affiliate Disclosure: We may earn a commission when you click on affiliate links and make a purchase at no extra cost to you. Recommendations are based on user value only. Please review the offer details before applying.

Calculate Your Annual Savings

Best Card for You

Based on your monthly spend of ₹10,000, we recommend:

Already have a bill?

Use our Fuel Bill Generator to track your expenses before applying for a card.

Critical Comparison Table: 2026 Edition

| Card Name | Fuel Brand | Max Value-Back | Best For | Annual Fee | Fee Waiver | Action |

|---|---|---|---|---|---|---|

RBL XTRABest Value | IOCL | 8.5% | Heavy commuters | ₹1,500 | ₹2.75L spend | Apply Now |

SBI OctaneBest for Travel | BPCL | 7.25% | Travelers + lifestyle | ₹1,499 | ₹2L spend | Apply Now |

IDFC Power+ | HPCL | 6.5% | Families + utilities | ₹499 | ₹1.5L spend | Apply Now |

Standard Chartered | Any | 5% | Brand-agnostic | ₹750 | ₹90K spend | |

HDFC IOCL | IOCL | 5% | Budget users | ₹500 | ₹50K spend | Apply Now |

Best Fuel Cards with NO Annual Fee

Free fuel credit cards with no annual fee (or fee waived on spend) offer the best cashback and rewards without extra cost. Below are the top picks for BPCL fuel card, IndianOil credit card, and HPCL fuel card options that keep your wallet light.

| Card | Network | Cashback/Rewards | Annual Fee | Extra Perks | Notes |

|---|---|---|---|---|---|

| SBI BPCL Octane Credit Card | BPCL | 7.25% value back | Waived on spend | Grocery/dining rewards | BPCL fuel card, no annual feeApply Now |

| Axis Bank IndianOil Credit Card | IOCL | 20 EDGE pts/Rs 100 on IOCL fuel (~4% back) | Rs 500 (waived on Rs 3.5L yearly spend) | Welcome Rs 250 on first fuel, 1% surcharge waiver, RuPay/UPI, dining & travel offers | IndianOil credit card, fuel cashbackApply Now |

| ICICI HPCL Coral Credit Card | HPCL | 2.5% cashback at HPCL pumps | Waived on spend | Payback points | HPCL fuel card, fuel surcharge waiverApply Now |

Best Lifetime Free Fuel Cards

Lifetime free fuel credit cards charge zero joining or annual fees forever. They are ideal if you want cashback on fuel and everyday spends without worrying about fee waivers. Here are the best lifetime free fuel card and lifetime free credit card India options.

| Card | Network | Cashback/Rewards | Annual Fee | Extra Perks | Notes |

|---|---|---|---|---|---|

| Axis Bank Fibe Credit Card | Visa | 3% cashback commute/food | Lifetime free | 1% on other spends | Lifetime free fuel cardApply — Link coming soon |

| SBI Cashback Credit Card | Visa | 5% cashback online | Lifetime free | 1% offline spends | Lifetime free credit card IndiaApply Now |

Best BPCL, IOCL & HPCL Fuel Credit Cards

Co-branded cards with Bharat Petroleum (BPCL), Indian Oil (IOCL), and Hindustan Petroleum (HPCL) give the best rewards at their respective pumps. Compare the top BPCL fuel credit card, IOCL, and HPCL options plus the best fuel cashback card India for multi-brand flexibility.

| Card | Network | Cashback/Rewards | Annual Fee | Extra Perks | Notes |

|---|---|---|---|---|---|

| SBI BPCL Credit Card | BPCL | 4.25% value back | Waived on spend | Grocery/dining rewards | BPCL fuel credit cardApply Now |

| HDFC Bharat Cashback Card | HPCL/IOCL | 5% cashback on fuel & bills | Low annual fee | Cashback on utilities | Fuel cashback card IndiaApply Now |

Best CNG Fuel Credit Cards

CNG fuel card and HPCL CNG credit card options help you save on both petrol/diesel and CNG. The best picks offer surcharge waiver, rewards on CNG, and perks like roadside assistance. Below is a comparison of the top CNG fuel credit cards.

| Card | Network | Cashback/Rewards | Annual Fee | Extra Perks | Notes |

|---|---|---|---|---|---|

| HPCL IDFC FIRST Power+ Credit Card | HPCL/CNG | Up to 6.5% savings on fuel & CNG | ₹499 (waived on spend) | Roadside assistance, surcharge waiver | CNG fuel card, HPCL CNG credit cardApply Now |

Introduction: Why Fuel Credit Cards Matter in 2026

As India's fuel prices continue to hover around ₹87–₹107 per litre across major cities, fuel expenses have become one of the largest controllable costs in a household budget. For the average commuter spending ₹10,000 monthly on fuel, this translates to ₹120,000 annually—money that could be redirected with intelligent card selection.

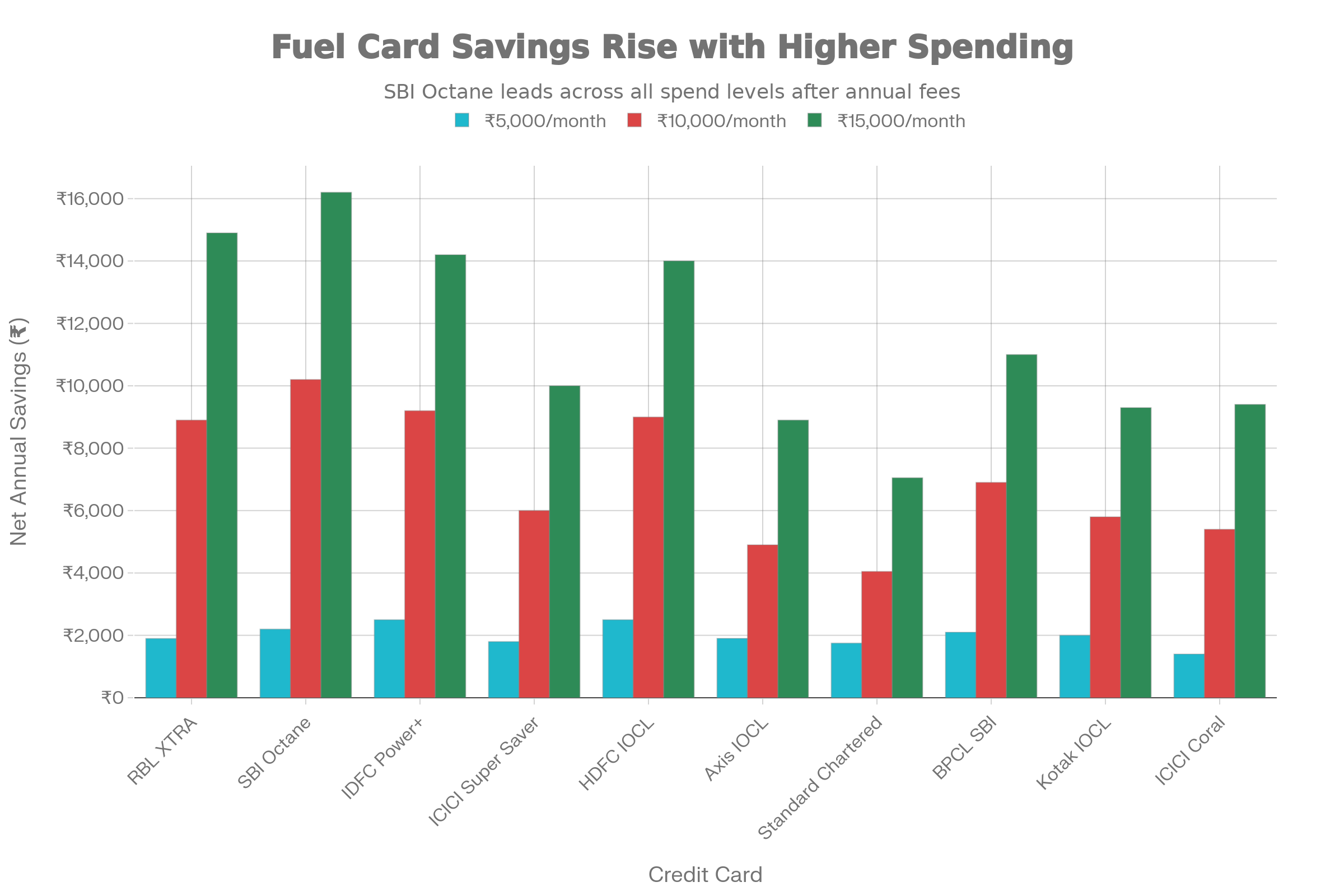

The fuel credit card landscape has evolved significantly from the basic 1% surcharge waiver model. Modern fuel cards now offer a sophisticated blend of accelerated reward points, direct cashbacks, loyalty perks, and lifestyle benefits. In 2026, savvy cardholders using the right fuel card can effectively cut annual fuel bills by 10–12%, saving between ₹8,000–₹14,400 per year even before considering bonus rewards.

This comprehensive guide analyzes the top 10 fuel credit cards in India, their actual value propositions, hidden charges, and how to calculate which card delivers maximum returns for your specific spending profile.

How Fuel Credit Cards Work: The Complete Mechanics

Before diving into individual cards, understanding the underlying mechanics ensures you don't fall victim to hidden charges or unrealistic marketing claims.

The Three Revenue Streams

1. Surcharge Waivers (1% of Transaction)

When you swipe a credit card at a petrol pump, the merchant (fuel station) charges a 1–3% surcharge to offset payment processing fees. Most co-branded fuel cards waive this fee, typically capped at ₹50–₹250 per month. However, there's a catch: the 18% GST levied on this surcharge is non-refundable.

Example: Filling ₹1,000 fuel

- Surcharge (1%): ₹10

- GST on surcharge (18%): ₹1.80

- Total charged: ₹1,011.80

- Bank credits back: ₹10 (surcharge only)

- Your net cost: ₹1,001.80 (you still pay ₹1.80 GST)

2. Reward Points / Value-Back

Cards offer accelerated points typically ranging from 10–30 points per ₹100 spent on fuel. Each point is worth ₹0.20–₹1.00 depending on redemption method. The total value-back typically ranges from 3.5% to 8.5%, making this the primary saving mechanism.

3. Lifestyle Rewards

Most premium fuel cards bundle additional benefits (lounge access, movie discounts, dining rewards) that add 1–3% effective value on non-fuel spends.

Critical Limitations Most Users Miss

- Monthly Spending Caps: Most cards limit eligible fuel spends to ₹5,000–₹12,000 monthly. Exceed this, and you earn zero rewards on additional fuel spends.

- Transaction Range Restrictions: Many cards only award benefits on transactions between ₹400–₹5,000. A ₹6,000 fill-up might not trigger rewards on ₹1,000 of that amount.

- Brand-Specific Restrictions: IOCL cards don't work optimally at BPCL pumps. You'll pay the surcharge but earn minimal or zero rewards.

- Rewards Redemption Friction: Converting points to actual fuel vouchers often involves:

- Minimum redemption thresholds (₹500–₹2,000)

- Catalogs with limited fuel denominations

- 2-year expiry on points

- Non-GST Refund: The 18% tax on surcharge is never waived, costing you ₹1.80 per ₹1,000 transaction.

Top 10 Fuel Credit Cards in India for 2026: Detailed Analysis

1. IndianOil RBL Bank XTRA Credit Card – The Highest ROI Card for 2026

Best For: Heavy commuters, commercial vehicle owners, long-distance travelers

Fees & Waivers:

- Joining Fee: ₹1,500 + GST

- Annual Fee: ₹1,500 + GST

- Fee Waiver: Annual spends ≥ ₹2.75 lakhs

Value-Back Structure:

- Fuel at IOCL: 7.5% reward points (20 points per ₹100)

- Groceries: 10 points per ₹100

- Surcharge Waiver: 1% up to ₹200/month

- Total Value-Back: 8.5% (highest in India)

Real Savings Calculation:

Monthly fuel: ₹10,000 → Annual fuel: ₹120,000

- Fuel rewards: 120,000 × 7.5% = ₹9,000

- Surcharge waiver: 12 × ₹200 = ₹2,400

- Annual fee: -₹1,500 (approx, assuming waiver)

Net annual saving: ₹9,900 ✓ Highly profitable

Verdict: Best card for high-volume IOCL users. If you consistently spend >₹10,000/month on fuel, this card's ROI is unbeatable.

2. BPCL SBI Card Octane – The Premium Lifestyle & Fuel Hybrid

Best For: Premium spenders wanting fuel + lifestyle benefits

Value-Back Structure:

- BPCL Fuel: 6.25% value-back (25 reward points per ₹100)

- Dining & Movies: 10x points (2.5% value-back)

- Additional Perk: 4 complimentary domestic airport lounge visits/year

Real Savings Calculation:

Monthly fuel: ₹10,000 → Fuel rewards: ₹625/month = ₹7,500/year

Lounge access value: ~₹4,000/year (4 visits × ₹1,000)

Annual fee: -₹1,499

Net annual benefit: ₹10,001 ✓ Excellent for travelers

Verdict: Ideal if you combine fuel savings with business travel and dining. The lifestyle perks add 10–15% incremental value.

3. IDFC FIRST Power+ Credit Card – Best for LPG, Utilities & Family Savings

Best For: Suburban families, LPG users, household bill payers

Value-Back Structure:

- HPCL Fuel & LPG: 30 reward points per ₹150 = 5% value-back

- Groceries & Utilities: 30 points per ₹150 = 5% value-back

- Unique Feature: Points never expire

Real Savings Calculation:

- Fuel ₹8,000/month: ₹400/month = ₹4,800/year

- LPG ₹2,000/month: ₹100/month = ₹1,200/year

- Utilities ₹3,000/month: ₹150/month = ₹1,800/year

- HP Pay bonus (₹8,000 fuel): ₹120/month = ₹1,440/year

- Annual fee: ₹0 (easily waived)

Net annual benefit: ₹9,240 ✓ Great value

Verdict: Best "all-rounder" for families managing multiple expenses. The never-expiring points feature is a huge advantage.

4. ICICI Bank HPCL Super Saver Credit Card

Best For: Movie enthusiasts, entertainment spenders, HPCL users

Value-Back: HPCL Fuel: 4% value-back + 1% surcharge waiver = 5% total. MovieTickets (BookMyShow): 25% instant discount.

Verdict: If you split spending between fuel and entertainment (movies, dining), this card offers balanced value.

5. IndianOil HDFC Bank Credit Card – The Beginner's Choice

Best For: First-time cardholders, two-wheeler owners, low-mileage commuters

Value-Back: IOCL Fuel: 5% in Fuel Points. Annual Fee: ₹500 (waived on ₹50,000 spend).

Verdict: Perfect entry-level card. No complex redemption, easy fee waiver, ideal for budget-conscious users.

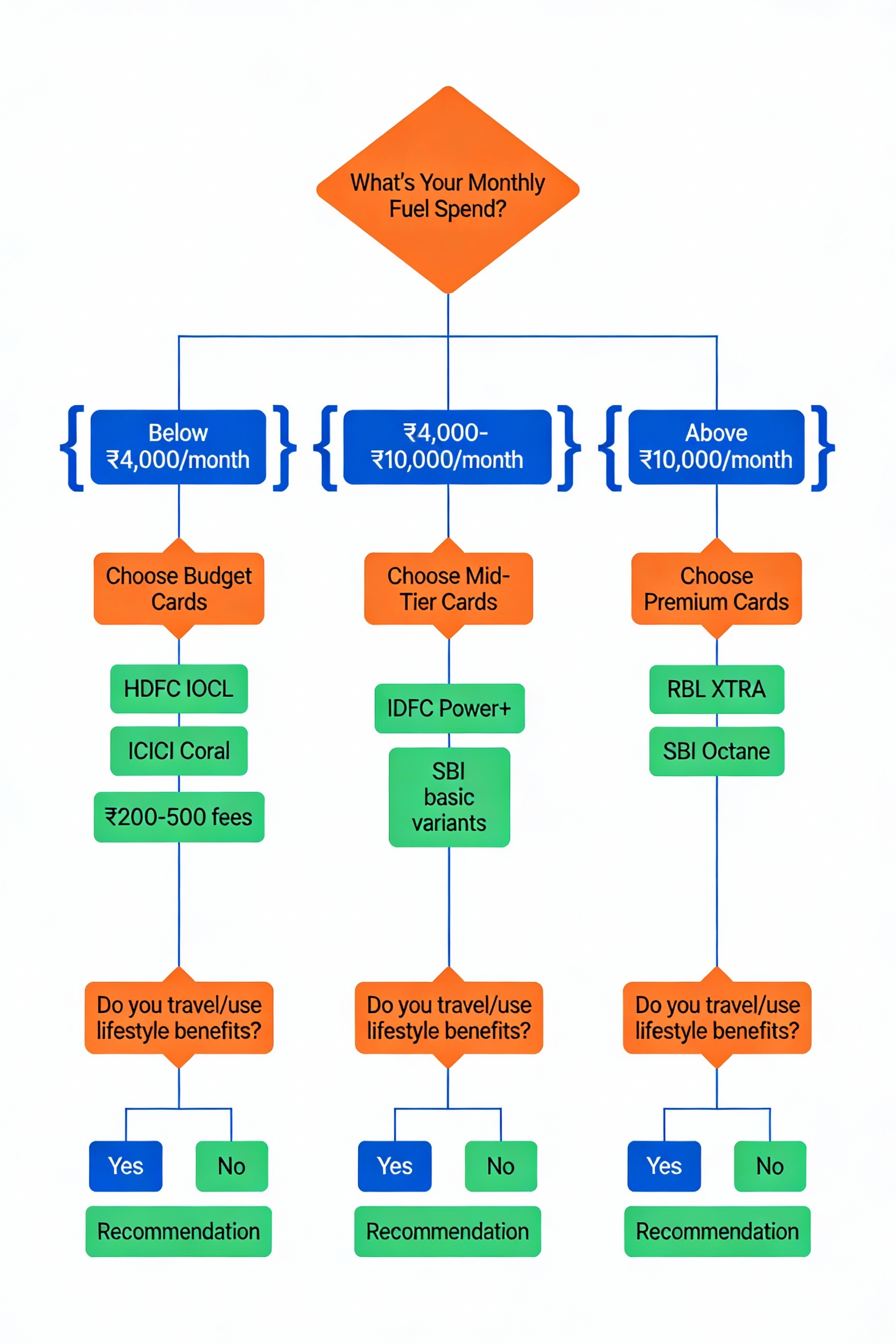

2026 Buying Guide: How to Pick Your Perfect Card

Step 1: Calculate Your Actual Fuel Spend

Track 3 months of fuel expenses to identify your true monthly average:

- ₹2,000–₹4,000/month: Stick with ₹199–₹499 fee cards (Coral, HDFC, Kotak)

- ₹4,000–₹8,000/month: Choose ₹499–₹750 fee cards (IDFC, SBI Basic, Axis)

- ₹8,000–₹15,000/month: Opt for premium cards (RBL XTRA, SBI Octane)

- ₹15,000+/month: RBL XTRA offers unmatched ROI

Step 2: Brand Loyalty Mapping

Create a fuel outlet audit:

- Which fuel brand's outlet is closest to your home?

- Which brand is on your commute to work?

- Do you travel across state borders (may require multiple brands)?

FAQ: 2026 Edition – Addressing Common Questions

The Verdict: Which Card Should YOU Choose?

Choose RBL XTRA if:

- You spend >₹10,000/month on IOCL fuel

- You're willing to commit to ₹2.75 lakh annual spend

- You value maximum fuel rewards above lifestyle perks

- Fuel is your primary spending category

Choose SBI Octane if:

- You travel frequently (value lounge access)

- You combine fuel with dining and entertainment spending

- You spend ₹10,000/month and value ₹4,000+ annual lounge value

- BPCL is your preferred brand

Choose IDFC Power+ if:

- You manage household expenses (fuel + utilities + groceries)

- You want never-expiring reward points

- You use HP Pay App for additional discounts

- You prefer balanced rewards across categories

Choose Standard Chartered Super Value if:

- You use multiple fuel brands

- You want flexibility without brand lock-in

- You travel across states frequently

Choose HDFC IOCL or Coral if:

- You spend <₹5,000/month on fuel

- You want simplicity without complexity

- You prefer lowest fees and straightforward rewards

Conclusion: Maximizing Fuel Card Value in 2026

The fuel credit card market has matured significantly. While 1% surcharge waivers were once the primary benefit, modern cards deliver 5–8.5% total value-back through combined rewards, surcharge waivers, and lifestyle perks. The key to maximizing value isn't choosing the "best" card—it's choosing the right card for your specific spending profile.

By understanding the mechanics of rewards, hidden charges, monthly caps, and lifestyle integrations, you can engineer annual fuel savings of ₹5,000–₹12,000 while simultaneously unlocking 2–4% additional value from secondary spending categories.

Note: All reward structures, fees, and benefits mentioned are valid as of January 2026 per official bank portals. Always verify the latest terms on the issuer's website before application, as banks frequently update benefit tiers, caps, and eligibility criteria. This guide is for informational purposes and should not be construed as financial advice.

Related Credit Cards

Affiliate Disclosure: We may earn a commission when you click on affiliate links and make a purchase at no extra cost to you. Recommendations are based on user value only. Please review the offer details before applying.

SBI BPCL Octane Credit Card

Get upto 7.25% value back on Fuel spends. Earn upto 10 Reward Points on every Rs 100 spent. Enjoy 4 Complimentary lounge visits annually.

RBL Bank Indian Oil XTRA Credit Card

Enjoy 8.5% value back on fuel purchases at Indian Oil stations. Receive 3,000 Fuel Points on your first transaction of Rs 500 or more.

HDFC Bank Indian Oil Credit Card

Get Upto 50 litres of Free Fuel Annually. Earn Upto 5% Fuel Points for every spend. Free IndianOil XTRAREWARDS membership.

Axis IOCL Rupay Credit Card

4% back on IOCL fuel. 1% fuel surcharge waiver. 1% back on online shopping.

IDFC FIRST CREDIT CARD: Fuel Savings Upto 5%*

Fuel Savings Upto 5%* Unlimited Never Expiring Rewards, Rs 250 cashback on 1st HPCL fuel transaction of Rs 250 or above*, 3.5% savings on HPCL fuel and LPG spends. Additional 1.5% savings as Payback Rewards when using the HP Pay app Complimentary Roadside Assistance upto 4 instances per year, valued at Rs 1,399 annually

Related Resources

- → Best Lifestyle Credit Cards for Middle Class (2026) - Free calculator: compare cashback on shopping, dining & fuel. Instant results, no signup.

- → Best Luxury Credit Cards in India (2026) - Free premium calculator: lounge access, golf, dining & travel perks. Instant results, no signup.

- → The Best Way to Use Credit Cards in India (2026 Guide) - Master credit card best practices, avoid debt traps, and maximize rewards

- → Fuel Credit Cards Comparison - Side-by-side comparison of top fuel credit cards

- → Fuel Cost Calculator - Calculate your monthly and annual fuel expenses

- → Fuel Expense Documentation Guide - Master audit-ready record keeping

- → GST Compliance Guide - Understand tax implications for fuel purchases